This method is also helpful for married couples who are just starting to budget for their household.

This is different from the General Ledger where all transactions are recorded. Remember, this serves as your expense ledger, and its sole purpose is to record your expenses. Then, add to the list as you become more accustomed to budgeting and as needed. If you haven’t created a budget before and you’re in the process of tracking your personal expenses, you can include basic and regular expenses first.

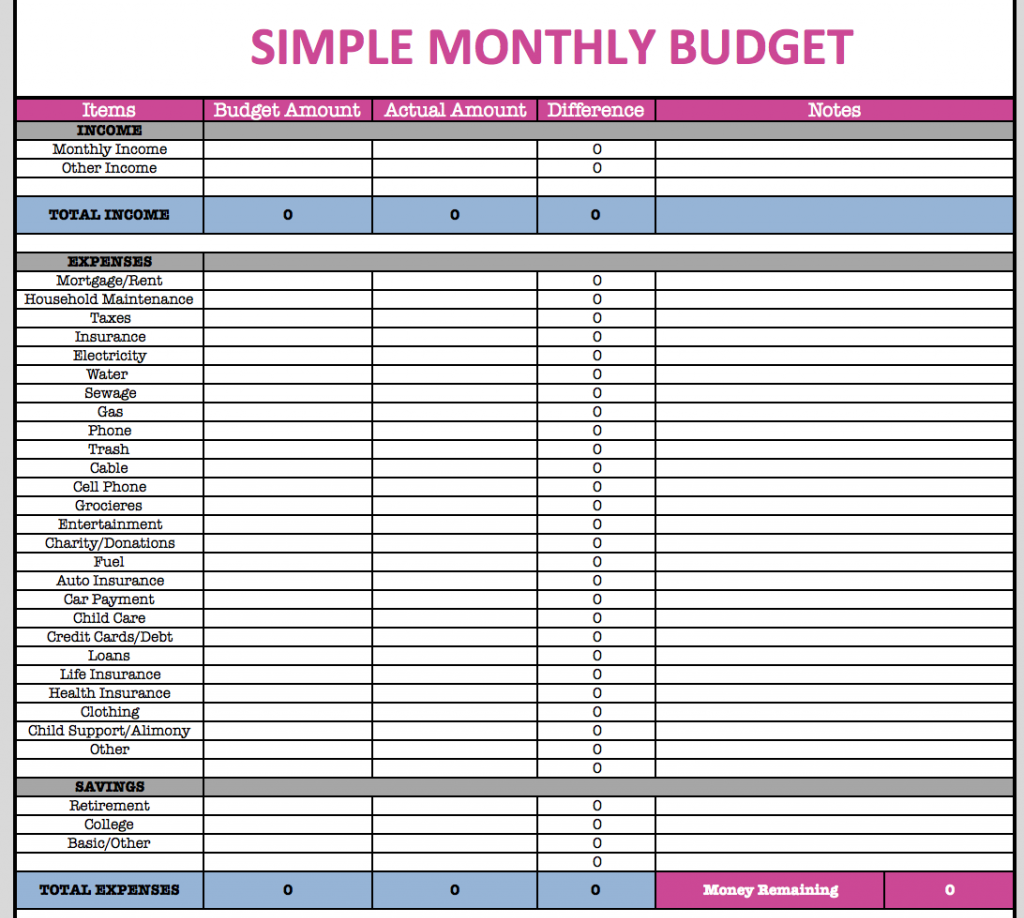

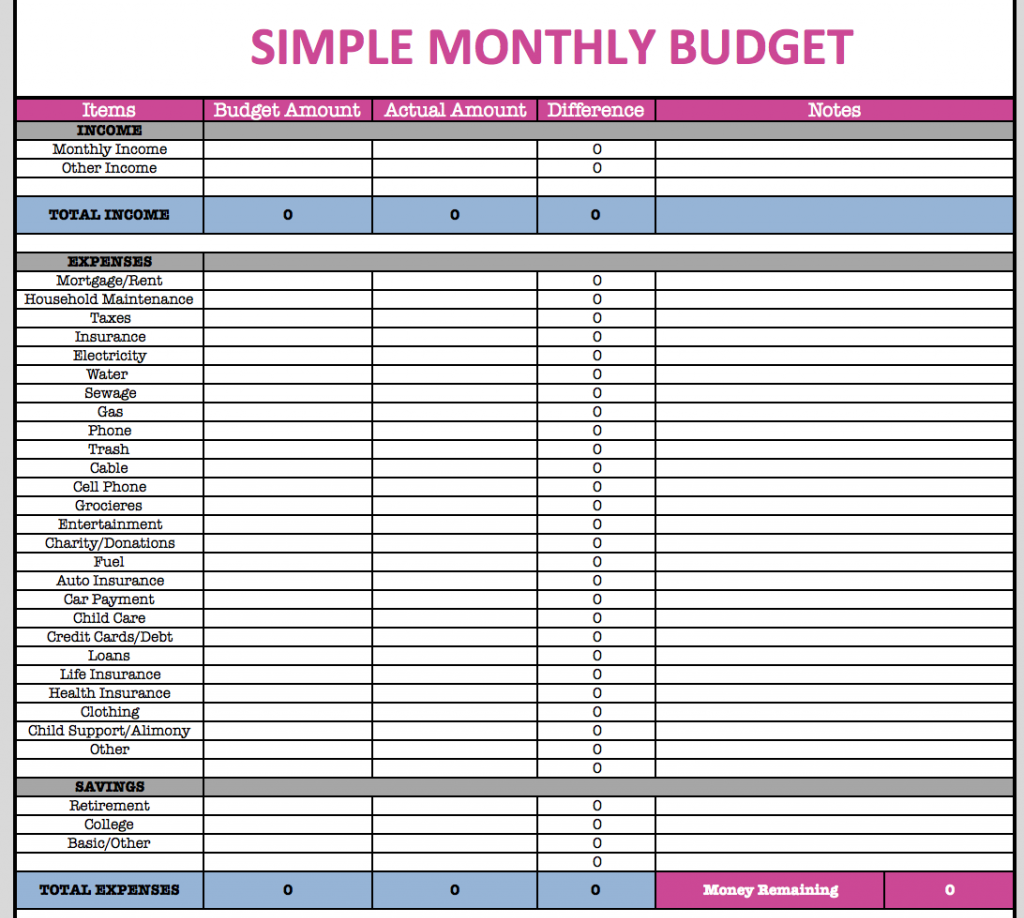

The Actual Amount You Spent for Each Expense - Fill this out after the duration of your budget (e.g. Budget for Each Expense - Here, you write the actual amount you want to spend on each item.  Type of Expense - Examples of this are rent, utilities, groceries, clothing, and transportation. You can create your ledger using digital sheets or with a notebook and pen. If you already have a budget, taking note of your transactions helps you track how much cash you still have left for each expense.Ī good way to track your expenses is through a ledger. The disadvantage is you can easily slack off or even forget doing it, and you may not remember every spend you made. The great thing about developing this habit is it forces you to rethink where you’re spending your money. You can use an app, your phone’s note-taking feature, or a pen and notebook. If you want to deep-dive into extreme budget hacks, start taking note of every transaction you make.

Type of Expense - Examples of this are rent, utilities, groceries, clothing, and transportation. You can create your ledger using digital sheets or with a notebook and pen. If you already have a budget, taking note of your transactions helps you track how much cash you still have left for each expense.Ī good way to track your expenses is through a ledger. The disadvantage is you can easily slack off or even forget doing it, and you may not remember every spend you made. The great thing about developing this habit is it forces you to rethink where you’re spending your money. You can use an app, your phone’s note-taking feature, or a pen and notebook. If you want to deep-dive into extreme budget hacks, start taking note of every transaction you make.

Record Your Expenses and Budget on a Ledger

0 kommentar(er)

0 kommentar(er)